What U.S. expats often misunderstand about the FEIE Standard Deduction

The Foreign Earned Earnings Exclusion Explained: An Overview to Enhancing Your Common Deduction

The Foreign Earned Revenue Exemption (FEIE) is a vital tax stipulation for united state residents and resident aliens living abroad. It permits qualified expatriates to omit a considerable portion of their foreign-earned earnings from federal tax obligations. Comprehending the subtleties of FEIE can cause substantial tax obligation cost savings. Many individuals overlook important details that can impact their qualification and benefits. Checking out these aspects may disclose chances for boosted tax results.

Understanding the Foreign Earned Earnings Exemption

Although numerous migrants seek opportunities abroad, understanding the Foreign Earned Earnings Exemption (FEIE) is vital for handling their tax commitments. This arrangement enables united state citizens and resident aliens living overseas to omit a specific quantity of their gained income from federal taxation. The FEIE was established to ease the tax obligation burden on individuals who live outside the United States, recognizing the unique financial obstacles they might encounter.

Eligibility Needs for FEIE

How to Assert the FEIE

To successfully assert the Foreign Earned Revenue Exclusion (FEIE), taxpayers must initially validate their eligibility based on specific requirements - FEIE Standard Deduction. The process includes several actions, consisting of filing the ideal kinds and offering needed documents. Understanding these procedures and needs is necessary for making best use of tax advantages while living abroad

Qualification Requirements

Eligibility for the Foreign Earned Income Exemption (FEIE) pivots on meeting certain standards set by the IRS. To certify, people must be U.S. people or resident aliens that earn earnings while functioning abroad. They require to establish a foreign tax home, which indicates their main business is outside the USA. In addition, applicants should fulfill either the Bona Fide Home Examination or the Physical Visibility Examination. The Authentic Residence Test needs that a taxpayer resides in a foreign nation for a whole tax obligation year, while the Physical Visibility Examination demands investing at the very least 330 complete days in an international country throughout a 12-month duration. Satisfying these demands is essential for asserting the FEIE.

Declaring Process Steps

Exactly how can one properly browse the procedure of asserting the Foreign Earned Revenue Exemption (FEIE)? Individuals need to establish their qualification based on the physical existence test or the bona fide home examination. As soon as verified, they need to finish internal revenue service Type 2555, which details international revenue and residency. This kind needs to be connected to their annual income tax return, usually Form 1040. It is important to accurately report all international made income and warranty conformity with the IRS guidelines. Additionally, taxpayers need to preserve proper documentation, such as international tax returns and evidence of residency. By adhering to these steps, individuals can efficiently declare the FEIE and potentially lower their gross income significantly, enhancing their total monetary position.

Computing Your Foreign Earned Income Exemption

While numerous expatriates look for to maximize their economic benefits abroad, recognizing the computation of the Foreign Earned Income Exemption is important for accurate tax obligation reporting. The Foreign Earned Earnings Exclusion enables qualifying people to leave out a specific quantity of their foreign earnings from united state taxes, which is changed each year for inflation. To compute this exclusion, expatriates have to establish their complete international earned earnings, which typically includes earnings, salaries, and expert fees made while staying in a foreign country.

Next off, they should finish IRS Type 2555, giving details about their international residency and job status. FEIE Standard Deduction. It is essential to fulfill either the bona fide home examination or the physical visibility test to get the exemption. As soon as these elements are established, the optimum allowable exclusion amount is used, minimizing the person's taxed income considerably. Precise estimations can bring about substantial tax financial savings for migrants living and functioning abroad

The Influence of FEIE on Other Tax Benefits

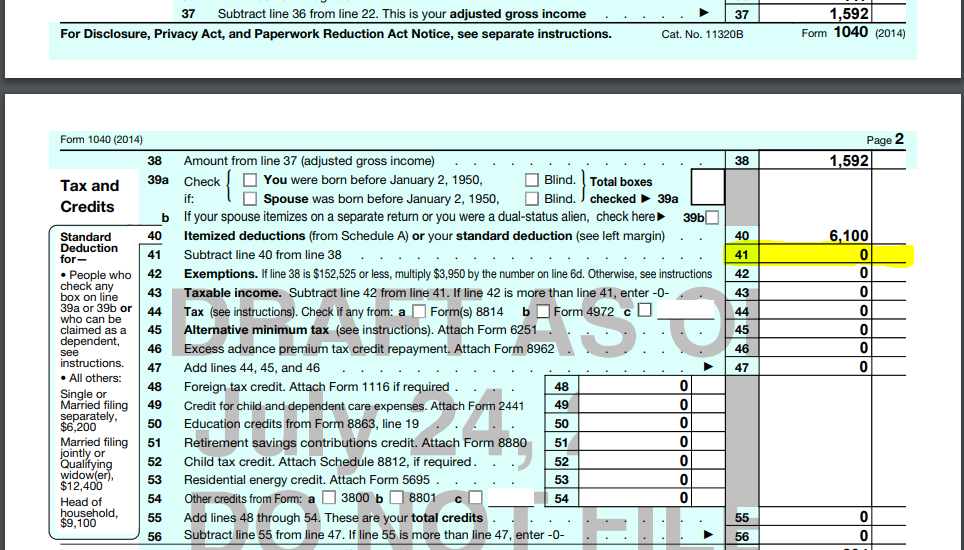

The Foreign Earned Income Exclusion (FEIE) can influence a person's eligibility for sure tax advantages, consisting of the standard reduction. By excluding foreign earned income, taxpayers may find their adjusted gross income impacted, which subsequently can impact their certification for various tax credit scores. Comprehending these interactions is important for optimizing tax results while living abroad.

Communication With Requirement Reduction

When individuals receive the Foreign Earned Revenue Exemption (FEIE), their eligibility for the typical deduction might be influenced, possibly changing their overall tax obligation. The FEIE enables taxpayers to omit a certain amount of gained earnings from U.S - FEIE Standard Deduction. taxation, which can bring about a lowered taxable earnings. Consequently, if the left out revenue exceeds the conventional deduction, it can lessen the advantage of declaring that deduction. In addition, taxpayers who utilize the FEIE Learn More might discover that their ability to itemize reductions is likewise influenced, as particular costs might be affected by the exclusion. Recognizing this interaction is vital for expatriates to optimize their tax advantages while making sure compliance with U.S. tax obligation legislations

Eligibility for Tax Obligation Credit Histories

Steering with the intricacies of tax credit ratings can be testing for expatriates, particularly because the Foreign Earned Revenue Exclusion (FEIE) can substantially impact qualification for these advantages. The FEIE enables qualified individuals to leave out a considerable section of their foreign incomes from united state taxation, however this exemption can also impact access to various tax credit scores. Taxpayers that use the FEIE may discover themselves disqualified for credit ratings like the Earned Income Tax Credit Score (EITC), as these credit ratings generally require taxable income. In addition, the exclusion may limit the capability to declare specific reductions or credit scores connected with dependents. Recognizing the interaction in between the FEIE and offered tax debts is vital for migrants aiming to enhance their tax situation.

Typical Mistakes to Prevent When Asserting FEIE

Commonly, expatriates encounter numerous pitfalls while declaring the Foreign Earned Revenue Exemption (FEIE), which can cause costly errors or missed out on possibilities. One frequent error is stopping working to fulfill the physical presence or bona fide house test, which is necessary for qualification. Additionally, expatriates typically forget the need to file Form 2555 correctly, causing incomplete or unreliable entries.

An additional usual error involves incorrectly determining international gained revenue, as several do not account for all relevant income sources. Some expatriates mistakenly assume they can exclude all their earnings, unaware of the restrictions on the exemption quantity. Ignoring to preserve appropriate documentation, such as travel dates and residency status, can jeopardize a claim. Ultimately, misconstruing the effects of the FEIE on various other tax credit scores might cause unintentional tax liabilities. Understanding of these mistakes can facilitate a smoother asserting process and take full advantage of potential advantages.

Resources for Expats Navigating U.S. Tax Obligations

Steering U.S. tax obligation responsibilities can be challenging for migrants, particularly after running into pitfalls in asserting the Foreign Earned Earnings Exclusion (FEIE) To help browse these complexities, a range of resources are readily available. The IRS internet site offers considerable details on tax forms, frequently asked questions, and regulations especially tailored for migrants. Additionally, organizations like the American People Abroad (ACA) and the Expat Tax Professionals deal guidance and support click over here to ensure conformity with tax laws.

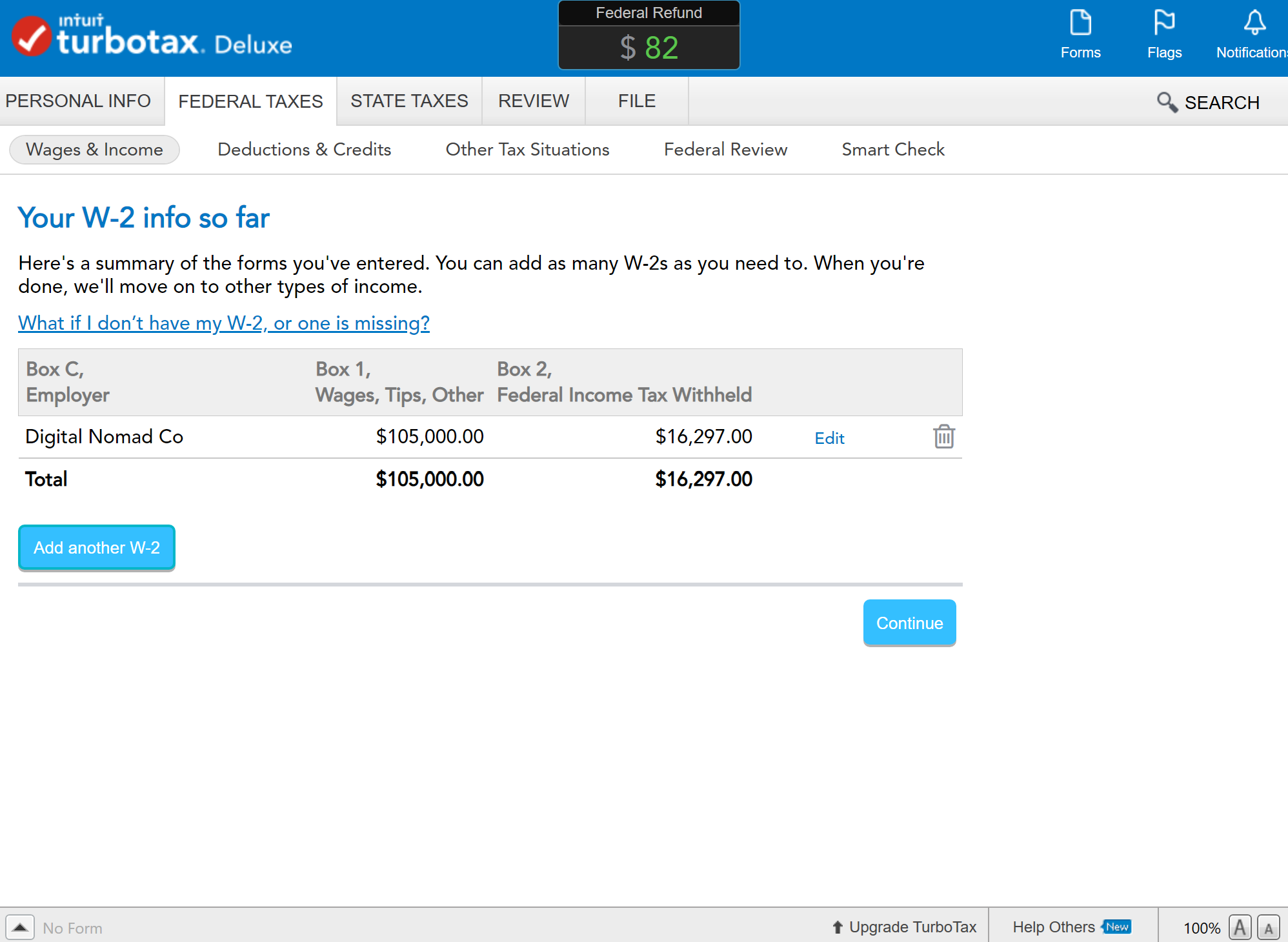

On-line forums and neighborhoods, such as the Deportee Forum, allow expatriates to share experiences and understandings, cultivating a supportive environment for those encountering similar challenges. Additionally, tax obligation prep work software, like copyright and H&R Block, commonly consists of attributes developed for deportees, making the filing procedure much more user-friendly. Engaging with these resources can empower expatriates to better understand their tax responsibilities and make the most of benefits like the FEIE.

Regularly Asked Inquiries

Can I Declare FEIE if I'M Independent Abroad?

Yes, freelance people abroad can assert the Foreign Earned Earnings Exclusion (FEIE) To qualify, they should meet specific requirements regarding residency and revenue, guaranteeing they stick to IRS guidelines for migrants.

Is the FEIE Applicable to Foreign Pensions?

The Foreign Earned Income Exemption (FEIE) is not relevant to international pensions. Pension plans are taken into consideration unearned earnings and do not get the exclusion, which especially puts on made income from work or self-employment abroad.

What Occurs if I Return to the United State Mid-Year?

If a specific returns to the U.S. mid-year, they may require to change their tax scenario. Their qualification for specific deductions and exemptions, including the Foreign Earned Revenue Exclusion, can be impacted by their residency standing.

Can FEIE Be Reported With Other Deductions?

Yes, the Foreign Earned Revenue Exclusion (FEIE) can be asserted together with other deductions. However, treatment must be required to guarantee appropriate conformity with tax regulations, as specific constraints may use based on private circumstances.

Just How Does FEIE Impact State Tax Obligations?

The Foreign Earned Earnings Exemption can decrease a taxpayer's government revenue tax obligation, yet it does not instantly influence state tax commitments, which vary by state and may still need coverage of international income.

Numerous migrants seek opportunities abroad, recognizing the Foreign Earned Revenue Exclusion (FEIE) is crucial for managing their tax responsibilities. By omitting international gained revenue, taxpayers may discover their modified gross revenue influenced, which in turn can impact their qualification for different tax obligation credit scores. Guiding via the complexities of tax debts can be Your Domain Name testing for migrants, specifically since the Foreign Earned Income Exemption (FEIE) can greatly impact qualification for these advantages. Taxpayers that utilize the FEIE may find themselves ineligible for credit scores like the Earned Income Tax Debt (EITC), as these credits generally require taxable revenue. Steering U.S. tax responsibilities can be challenging for expatriates, specifically after encountering risks in claiming the Foreign Earned Revenue Exclusion (FEIE)